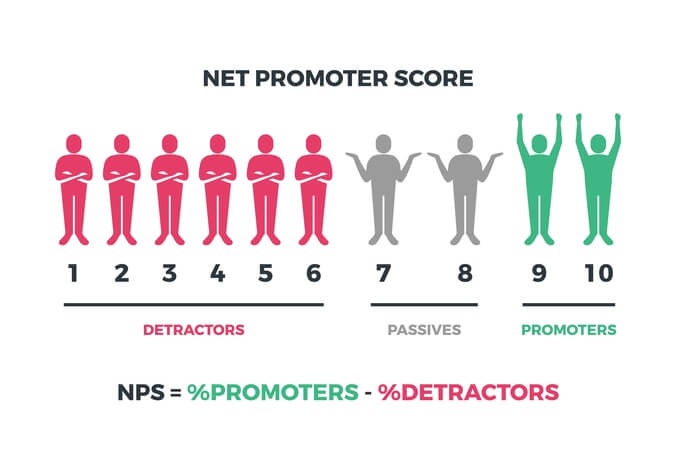

Net promoter score (NPS) is a valuable metric, used by a huge number of businesses as an indicator of customer loyalty. Although known for its simplicity, NPS has its own set of limitations.

It can certainly offer insights into customer satisfaction and can be a major driver of policy change, however, it isn’t without its limitations. One common criticism is that NPS does not reveal the root cause of a given customer’s opinions.

What Are The Two Types Of NPS

Relationship NPS

Relationship NPS is used to measure the overall satisfaction a customer has with a company. This is achieved by contacting customers at a non-specific time, such as via a quarterly email.

Transactional NPS

This is used to gauge a customer’s opinions in relation to a specific transaction. To measure this, a company can change the wording of the survey to refer to the most recent action a customer has taken.

Challenges With Transactional NPS

Because transactional NPS is based around a specific moment, it can be difficult to get an understanding of the customer’s general sentiment. It’s true that NPS is generally a good indication of overall customer loyalty, but it’s not always completely accurate, or easy to interpret.

Transactional NPS only captures a very specific part of the customer journey. For example, an NPS survey might be presented to customers directly after they’ve made an online purchase and may result in a high overall score.

However, if the quality control is poor and multiple customers receive the wrong items, they will end up unsatisfied with the buying process. In a case like this, your transactional NPS may be deceiving, as it only reflects the first part of the buyer’s journey.

Because of this limitation, it’s often advisable to include a follow-up question along the lines of “How can we improve our service?”. Finding ways like this to get extra information is an important part of collecting meaningful transactional NPS data, and any other type quantitative data for that matter.

Challenges With Relationship NPS

It can be a challenge to draw detailed conclusions from relationship NPS alone, as it is established by a single generic question and does not explain what factors have influenced the rating.

Imagine a banking company launched a completely new website and then starts to get a sudden surge in low NPS feedback, with many respondents being classed as ‘detractors’. The company will want to resolve the issues as a priority, but will have no clear indication of what the specific issue is.

Additionally, relationship NPS completely excludes the opinions of people who don’t respond to the questionnaire, as well as potential future customers in the wider community.

For companies to gain truly meaningful insights, relationship NPS needs to be used in conjunction with more targeted questions, as well as collecting more varied methods of feedback such as asking customers for feedback in-store.

Overcoming The Challenges Of Traditional NPS

By leveraging artificial intelligence and machine learning-powered platforms, businesses are now able to predict the NPS scores with a high level of accuracy and identify the contributing factors for every single customer, without having to survey all of them.

There are many potential gains for businesses that predict NPS accurately. A few of the main benefits are:

Save money on customer research and vast traditional NPS programs

Predicting NPS can help you save significantly on research. Instead of investing in expensive market research techniques, such as surveys, NPS predictions can accurately provide insight into specific customer segments populations you’ve never had contact with on a larger scale than otherwise possible.

Understand the factors driving NPS

Software solutions that predict NPS also expose the specific factors that drive NPS and to what extent they have an impact on individual scores. By understanding these factors, you can work to improve them. For example, for a telecoms company, a critical factor driving customers’ likelihood to recommend might be service reliability. Once this is known, the company can divert more resources to ensure better reliability for this segment

Increase your number of promoters

Customers who rate 7-8 on the NPS scale sit just below the ‘promoter’ range and are seen as ‘passive’. Predictive technology can help to identify who in this group is likely to be persuadable based on various factors, then specific actions can be taken to boost them up into the ‘promoter’ range.

Reduce your number of detractors

Similar to the way that passive customers can be identified and analyzed, the factors and demographics associated with dropping into the ‘detractor’ range can also be determined. By tracking these, it is possible to identify high-risk customers who may drop into the 0-6 range, and action can be taken to prevent it from happening. This is particularly important for so-called “silent detractors” (customers that do not show any sign of dissatisfaction but are most likely to be detractors based on the various factors under analysis (e.g. network experience, customer service experience, demographics, etc.)

|

Building A More Complete & Accurate NPS with Demographic Estimation >> |

|

Some Common Mistakes To Avoid When Using Data Science To Predict NPS>> |

What kinds of companies can benefit from predicting NPS?

Being able to accurately predict NPS is something that can be useful for almost any business, including retailers, telecoms providers, hospitality companies, and many more. The following points are sure signs that your business, in particular, could benefit from predicting NPS.

- Your business currently utilizes NPS but would like to get more insights from the information.

- You would like to be able to predict the effects that operational changes will have on your NPS scores, in order to reduce risk.

- Your business currently uses alternative measures of customer loyalty, customer satisfaction, and other forms of feedback to improve customer service and increase repeat custom.

- You currently have a strong reliance on customer testimonials and referrals to gain new customers.

- You want to have the ability to make better-informed decisions about the future direction of the business.

How can your business start accurately predicting NPS?

Predicting NPS is an innovative and effective way to gain powerful insights into both your existing and potential customers.

The simplest way to start predicting NPS for your business is to use specialized software. At Lynx Analytics, we work with clients to create custom business intelligence software products that solve specific challenges. We use the most advanced artificial intelligence and machine learning technologies to unlock the power of data and consistently improve business outcomes.

To learn more about how we can help you to improve customer loyalty through analytics, get in touch and schedule a consultancy session with our team.

Building A More Complete & Accurate NPS with Demographic Estimation

Demographic estimation refers to predicting characteristics of existing customers and potential target customers using advanced statistical modeling. For example, gender, location, age, and other characteristics can be estimated, then used to predict the NPS scores with greater accuracy.

This technique is particularly useful in any context where little is known about large portions of your customer base (e.g. prepaid customers, return shoppers that are not part of a loyalty program, etc.)

This process can help to hone marketing efforts by targeting certain demographics more accurately. These actions can improve the effectiveness of campaigns, reduce the cost per acquisition, and more. For example, an ecommerce business, who may not know much about individual customers, may want to gain insight into their customer base in order to build look-alike audiences and target advertising.

Some Common Mistakes To Avoid When Using Data Science To Predict NPS

Assuming Your Satisfaction Drivers Are Independent

Most businesses think that the satisfaction drivers of a customer are independent. However, it’s not true. For example, let’s say a customer support center has a total of 2 drop calls for a day. One from a 19 year old teen and one from a 52 year old adult. Now the 19 year old might not be satisfied and probably give an NPS score of 3-4 compared to the 52 year old adult who might seem it acceptable and provide a NPS score of 6-7. As you can see from this example, the satisfaction drivers are not independent and combine the number of drop calls and the age factor of the customer.

Attempting Deep Learning With Shallow Data

If we use small data (ie a small number of observations with a large number of features or unbalanced data with a small number of positive observations) to train a deep learning model, the model will easily get overfitted and may attach too much importance to irrelevant/unnecessary features and vice versa. There are robust solutions such as linear regression models, logistic regressions or shallow decision trees, that can be a more advantageous approach when working with small data.

Not Devoting Enough Attention To Data Preparation

Garbage in. Garbage out. Everyone knows that. Organizations often store data in several disparate systems that have different structures and aggregation logic. When creating data pipelines, analysts are left with duplicate, missing fields or inconsistent labels. Fields or values might also have the same meaning, but use different names or values across systems. Prior to automating any data pipeline, it is crucial to understand data location, structure and composition. This is why data engineering projects are essential first steps for companies implementing deep learning models.

High Variability In Data Entries

From variability in data entry practices to employees manually inputting wrong values into spreadsheets, inaccurate data entries pose a challenge to companies implementing predictive models. We have come across situations where approximately 40-50% of training datasets had to be thrown away because of the inability to perform proper matching between survey results and customer’s transactional information.